Tutorials & Guides

Learn how to maximize your trading performance with our comprehensive guides and video tutorials.

Getting Started

Learn how to access the indicator, add it to your TradingView chart, and understand the key trading signals.

Configuration

Master the indicator settings including signal factors, safety orders, dynamic exits, and risk management for optimal performance.

Automation

Set up automated trading with Capitalize.ai or 3Commas using webhooks and alert systems for hands-free execution.

Getting Started

Acquiring and Accessing the Indicator

If You Purchased the Indicator

After completing your purchase, you'll be redirected to a private access page where you'll need to enter your TradingView username. This ensures you're added to our exclusive, invite-only indicator list on TradingView.

If You're Redeeming a Free Trial

After submitting your TradingView username on our free trial page, you'll receive immediate access to the indicator. The trial version provides the same features as the full version but is limited to 3 days of use.

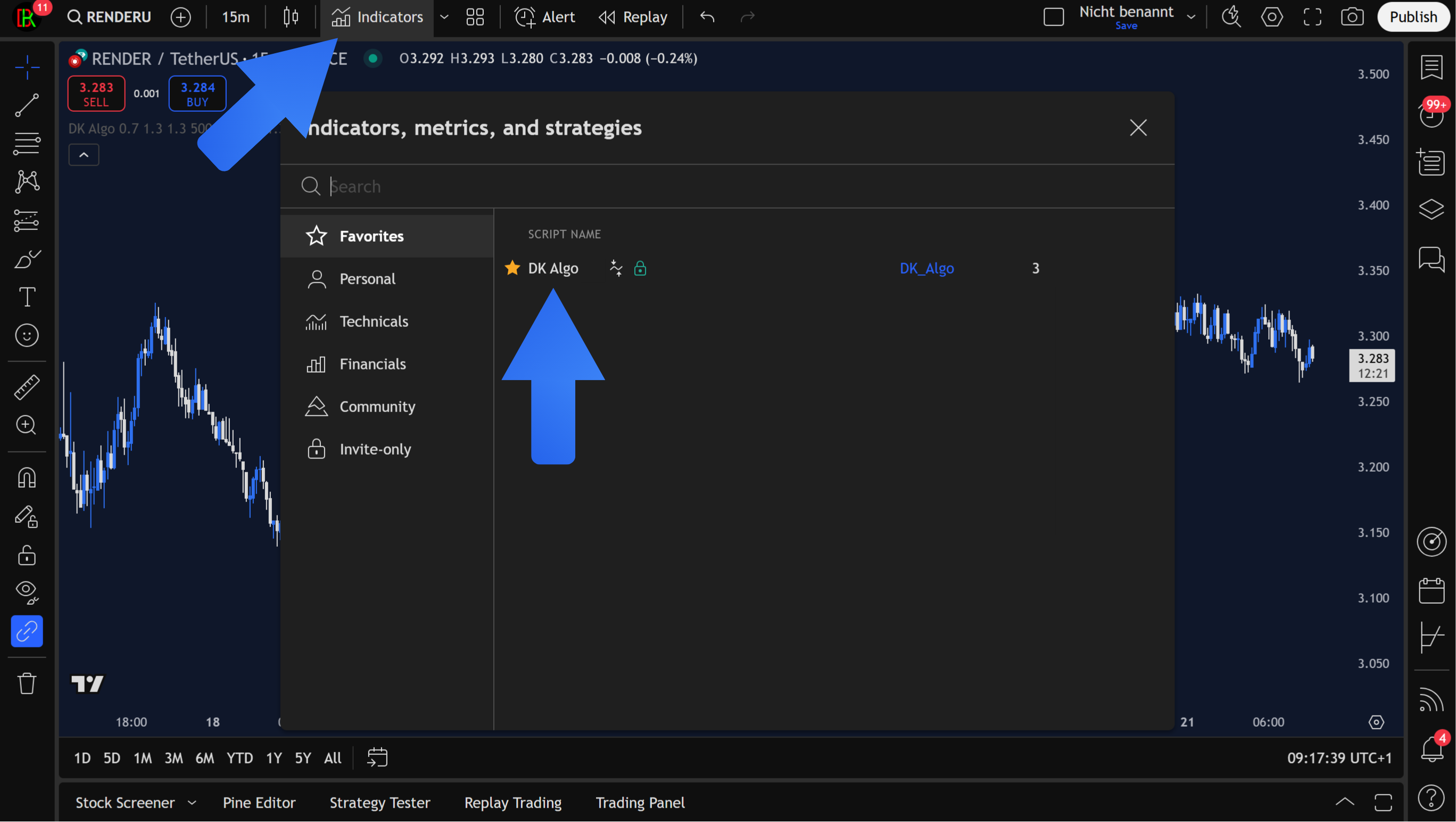

In both cases, follow the provided link directly to TradingView and click the Favourite icon next to the DK Algo indicator name for easier access in the future.

Adding to Your Chart

To add the DK Algo indicator to your chart:

- Log in to your TradingView account and open any chart (currencies, cryptocurrencies, or stocks)

- Click on the Indicators button at the top of the chart

- If you've favourited the indicator, find it in your Favourite Indicators section

- If not favourited, click on the Invite-only scripts tab and select DK Algo

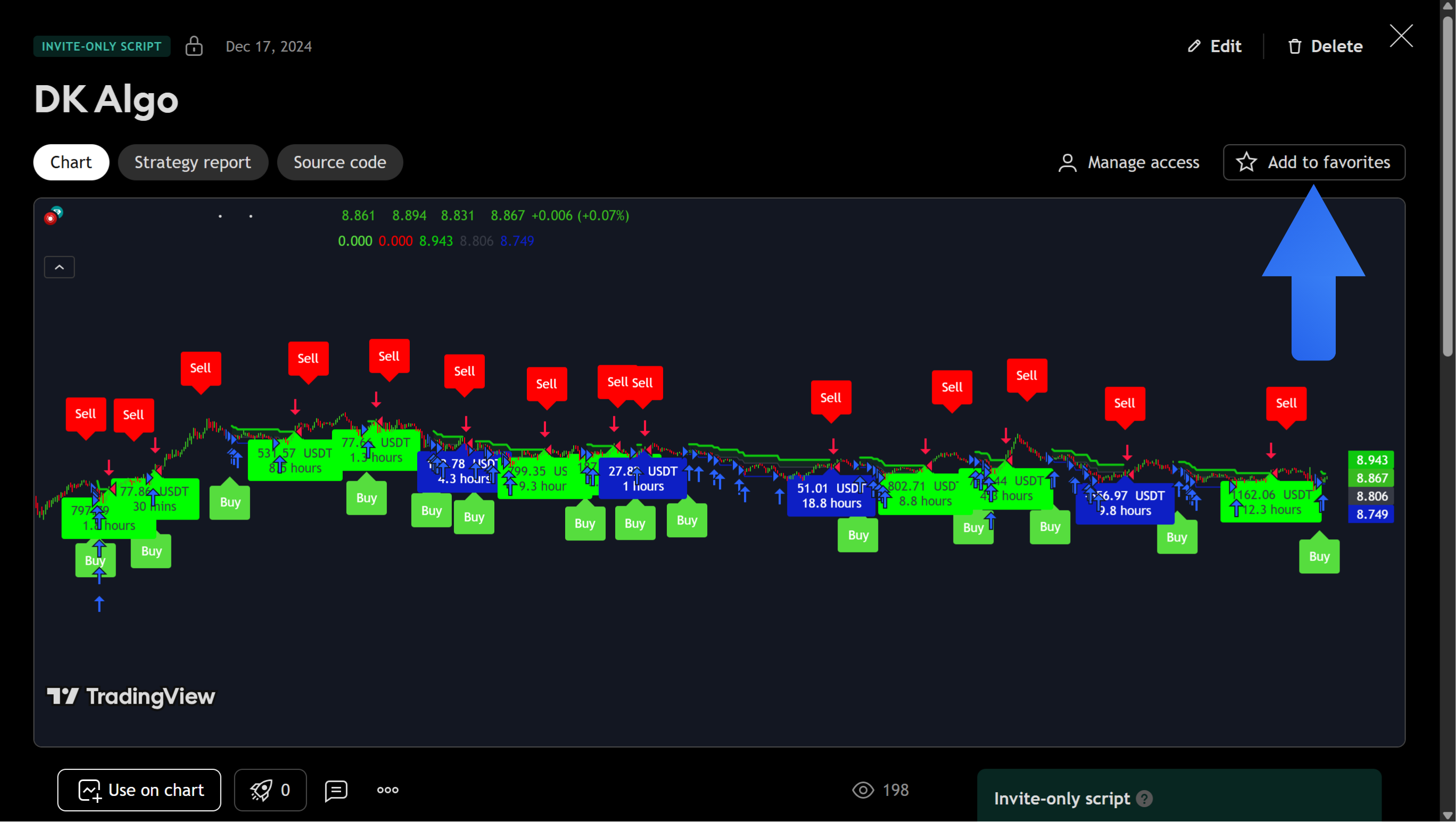

Understanding Indicator Signals

The indicator provides four main signal types:

- Buy - Triggered when price crosses below the lower band, indicating a potential reversal upwards

- Strong Buy - Highlighted at more extreme lower price levels, offering higher-probability trade entries

- Sell - Triggered when price crosses above the upper band, signaling potential downward moves

- Strong Sell - Activated at extreme upper price levels, indicating stronger selling opportunities

Configuration

General Settings

The default configuration settings are optimized for moderately volatile markets:

- Sell Signal Factor: Default is 1. Increasing this value requires stronger market movements for signals, resulting in fewer but more reliable signals.

- Buy Signal Factor: Default is 1. Similar to the Sell Signal Factor, higher values increase signal accuracy but reduce frequency.

The default settings serve as an effective starting point. Fine-tune these parameters based on your trading style and the specific market conditions.

Safety Order Strategy

This powerful feature helps improve your trade entries and exits during temporary price reversals:

- Safety Order Backtesting: Enabled by default

- Dynamic Exit: Enabled by default (positions close automatically based on Sell Signal Factor)

- Take Profit: Default set at 1.3%

- Base Order Size: Customizable based on your trading capital

- Safety Order Size: Customizable according to your risk management preferences

- Price Deviation for First Safety Order: Default set at 1%

- Volume Scale: Default multiplier of 1.35 (each subsequent safety order size increases)

- Step Scale: Default multiplier of 1.3 (spacing between safety orders)

- Safety Trades Count: Default is 6

Adjust these settings based on your risk tolerance and trading goals. Higher safety order counts provide better averaging but require more capital.

Risk Management

Carefully manage potential losses with built-in risk management:

- Stop Loss: Optional and disabled by default

- Stop Loss Percentage: Disabled by default; set this percentage according to your risk tolerance if enabled

Always use appropriate risk management and never risk more than you can afford to lose when trading.

Finding The Best Settings: Backtesting

Backtesting allows you to evaluate how your settings would have performed historically:

- Click the Strategy Tester button at the bottom of your TradingView chart

- Adjust parameter values to identify settings that maximize historical profitability

- We recommend leaving Dynamic Exit enabled, as it ensures positions close timely, minimizing losses

Select a fixed number of safety orders or consistently update the Initial Capital in the Properties section each time you adjust parameters. Misaligned capital assumptions can make your backtesting results inaccurate.

Automation

Choose an Automation Platform

Select a suitable automation platform. Recommended options include:

- Capitalize.ai: Free and easy-to-use automation for traders of all levels

- 3Commas: Powerful integration matching your DK Algo parameters, ideal for sophisticated safety order strategies

Choose the platform that best matches your trading experience level and strategy complexity.

Create the Safety Order Strategy Logic

Different platforms have unique logic setups. Here's an example using Capitalize.ai:

If Webhook(9121e74b-304e-4067-8a6d-13e10ce9959b) triggers, buy 488 USDT worth of RENDER/USDT (Binance), and buy 659 USDT worth of RENDER/USDT (Binance) at 0.6% below the current 15m bar open (GTC), and buy 889 USDT worth of RENDER/USDT (Binance) at 1.44% below the current 15m bar open (GTC), and buy 1,201 USDT worth of RENDER/USDT (Binance) at 2.62% below the current 15m bar open (GTC), and buy 1,621 USDT worth of RENDER/USDT (Binance) at 4.26% below the current 15m bar open (GTC), and buy 2,188 USDT worth of RENDER/USDT (Binance) at 6.57% below the current 15m bar open (GTC), and buy 2,954 USDT worth of RENDER/USDT (Binance) at 9.79% below the current 15m bar open (GTC).

Adjust the amounts and percentages according to your specific trading parameters and risk tolerance.

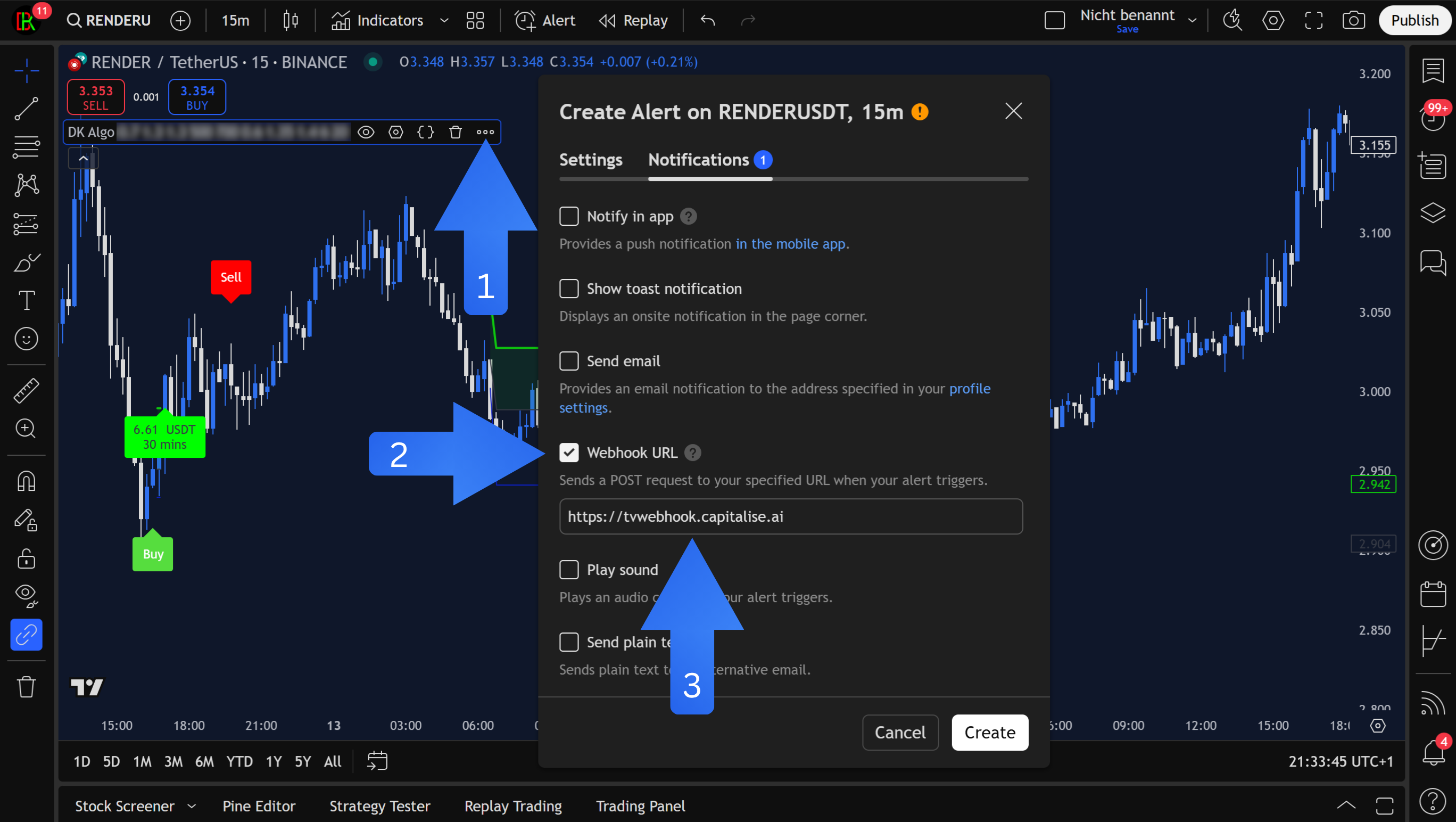

Configure TradingView Alerts

Your chosen automation platform provides:

- A Webhook URL

- Specific Alert Messages for buy and sell signals

To integrate these alerts in TradingView:

- Open your TradingView chart with DK Algo indicator

- Click on the indicator settings

- Paste Webhook Messages into the Buy Alert Message and Sell Alert Message fields

- Click the three dots next to the indicator title and select Add alert

- Under Notifications, enable the Webhook URL option

- Paste the provided Webhook URL into the webhook field

- Save and activate the alert

Activate Your Automated Strategy

Lastly:

- Return to Capitalize.ai or 3Commas and activate your strategy

- Initially, monitor closely to verify everything works as intended

Always monitor your automated trading system closely, especially during the first few trades, to ensure it's functioning properly according to your strategy.